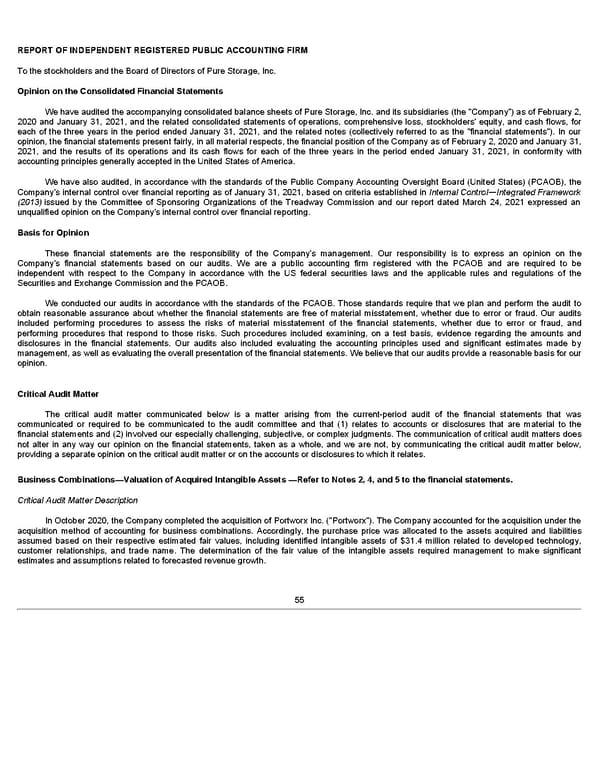

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the stockholders and the Board of Directors of Pure Storage, Inc. Opinion on the Consolidated Financial Statements We have audited the accompanying consolidated balance sheets of Pure Storage, Inc. and its subsidiaries (the "Company") as of February 2, 2020 and January 31, 2021, and the related consolidated statements of operations, comprehensive loss, stockholders' equity, and cash flows, for each of the three years in the period ended January 31, 2021, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of February 2, 2020 and January 31, 2021, and the results of its operations and its cash flows for each of the three years in the period ended January 31, 2021, in conformity with accounting principles generally accepted in the United States of America. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's internal control over financial reporting as of January 31, 2021, based on criteria established in Internal Control—Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated March 24, 2021 expressed an unqualified opinion on the Company's internal control over financial reporting. Basis for Opinion These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the US federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion. Critical Audit Matter The critical audit matter communicated below is a matter arising from the current-period audit of the financial statements that was communicated or required to be communicated to the audit committee and that (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates. Business Combinations—Valuation of Acquired Intangible Assets —Refer to Notes 2, 4, and 5 to the financial statements. Critical Audit Matter Description In October 2020, the Company completed the acquisition of Portworx Inc. ("Portworx"). The Company accounted for the acquisition under the acquisition method of accounting for business combinations. Accordingly, the purchase price was allocated to the assets acquired and liabilities assumed based on their respective estimated fair values, including identified intangible assets of $31.4 million related to developed technology, customer relationships, and trade name. The determination of the fair value of the intangible assets required management to make significant estimates and assumptions related to forecasted revenue growth. 55

Annua lReport Page 54 Page 56

Annua lReport Page 54 Page 56