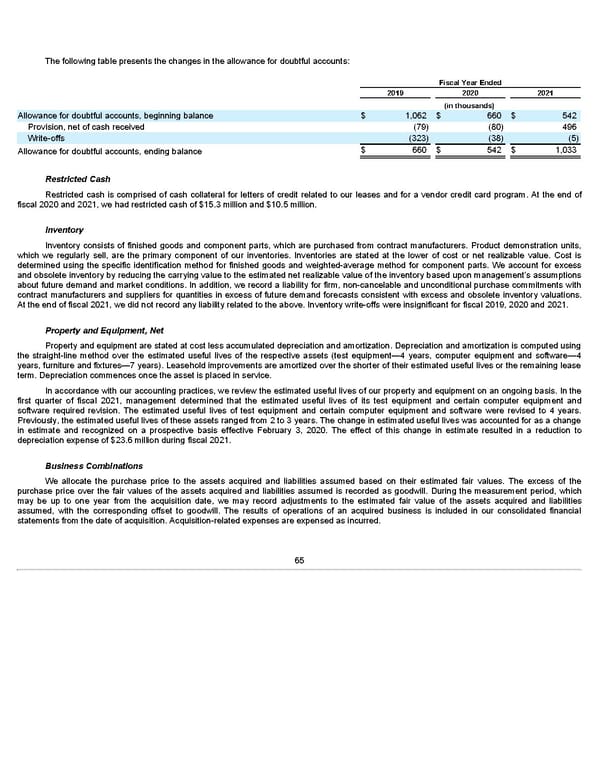

The following table presents the changes in the allowance for doubtful accounts: Fiscal Year Ended 2019 2020 2021 (in thousands) Allowance for doubtful accounts, beginning balance $ 1,062 $ 660 $ 542 Provision, net of cash received (79) (80) 496 Write-offs (323) (38) (5) $ 660 $ 542 $ 1,033 Allowance for doubtful accounts, ending balance Restricted Cash Restricted cash is comprised of cash collateral for letters of credit related to our leases and for a vendor credit card program. At the end of fiscal 2020 and 2021, we had restricted cash of $15.3 million and $10.5 million. Inventory Inventory consists of finished goods and component parts, which are purchased from contract manufacturers. Product demonstration units, which we regularly sell, are the primary component of our inventories. Inventories are stated at the lower of cost or net realizable value. Cost is determined using the specific identification method for finished goods and weighted-average method for component parts. We account for excess and obsolete inventory by reducing the carrying value to the estimated net realizable value of the inventory based upon management’s assumptions about future demand and market conditions. In addition, we record a liability for firm, non-cancelable and unconditional purchase commitments with contract manufacturers and suppliers for quantities in excess of future demand forecasts consistent with excess and obsolete inventory valuations. At the end of fiscal 2021, we did not record any liability related to the above. Inventory write-offs were insignificant for fiscal 2019, 2020 and 2021. Property and Equipment, Net Property and equipment are stated at cost less accumulated depreciation and amortization. Depreciation and amortization is computed using the straight-line method over the estimated useful lives of the respective assets (test equipment—4 years, computer equipment and software—4 years, furniture and fixtures—7 years). Leasehold improvements are amortized over the shorter of their estimated useful lives or the remaining lease term. Depreciation commences once the asset is placed in service. In accordance with our accounting practices, we review the estimated useful lives of our property and equipment on an ongoing basis. In the first quarter of fiscal 2021, management determined that the estimated useful lives of its test equipment and certain computer equipment and software required revision. The estimated useful lives of test equipment and certain computer equipment and software were revised to 4 years. Previously, the estimated useful lives of these assets ranged from 2 to 3 years. The change in estimated useful lives was accounted for as a change in estimate and recognized on a prospective basis effective February 3, 2020. The effect of this change in estimate resulted in a reduction to depreciation expense of $23.6 million during fiscal 2021. Business Combinations We allocate the purchase price to the assets acquired and liabilities assumed based on their estimated fair values. The excess of the purchase price over the fair values of the assets acquired and liabilities assumed is recorded as goodwill. During the measurement period, which may be up to one year from the acquisition date, we may record adjustments to the estimated fair value of the assets acquired and liabilities assumed, with the corresponding offset to goodwill. The results of operations of an acquired business is included in our consolidated financial statements from the date of acquisition. Acquisition-related expenses are expensed as incurred. 65

Annua lReport Page 64 Page 66

Annua lReport Page 64 Page 66