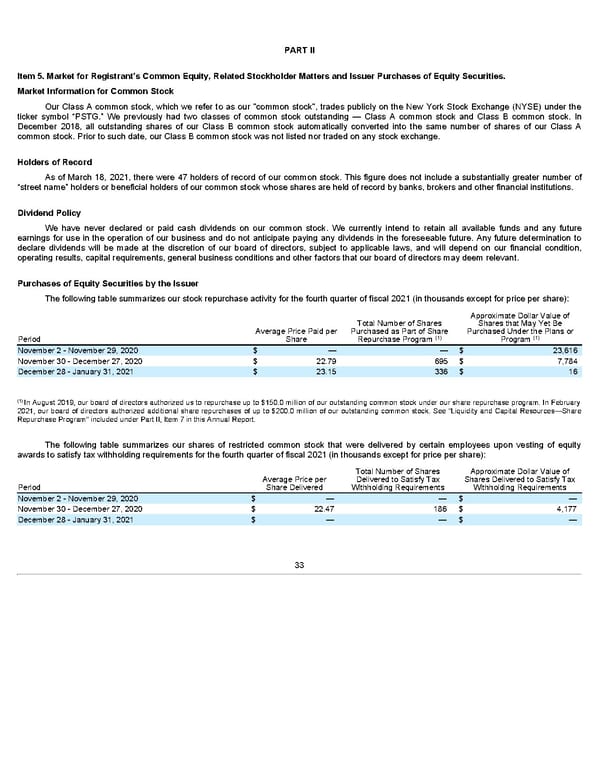

PART II Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. Market Information for Common Stock Our Class A common stock, which we refer to as our "common stock", trades publicly on the New York Stock Exchange (NYSE) under the ticker symbol “PSTG.” We previously had two classes of common stock outstanding — Class A common stock and Class B common stock. In December 2018, all outstanding shares of our Class B common stock automatically converted into the same number of shares of our Class A common stock. Prior to such date, our Class B common stock was not listed nor traded on any stock exchange. Holders of Record As of March 18, 2021, there were 47 holders of record of our common stock. This figure does not include a substantially greater number of “street name” holders or beneficial holders of our common stock whose shares are held of record by banks, brokers and other financial institutions. Dividend Policy We have never declared or paid cash dividends on our common stock. We currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying any dividends in the foreseeable future. Any future determination to declare dividends will be made at the discretion of our board of directors, subject to applicable laws, and will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant. Purchases of Equity Securities by the Issuer The following table summarizes our stock repurchase activity for the fourth quarter of fiscal 2021 (in thousands except for price per share): Approximate Dollar Value of Total Number of Shares Shares that May Yet Be Average Price Paid per Purchased as Part of Share Purchased Under the Plans or (1) (1) Period Share Repurchase Program Program November 2 - November 29, 2020 $ — — $ 23,616 November 30 - December 27, 2020 $ 22.79 695 $ 7,784 December 28 - January 31, 2021 $ 23.15 336 $ 16 (1) In August 2019, our board of directors authorized us to repurchase up to $150.0 million of our outstanding common stock under our share repurchase program. In February 2021, our board of directors authorized additional share repurchases of up to $200.0 million of our outstanding common stock. See "Liquidity and Capital Resources—Share Repurchase Program" included under Part II, Item 7 in this Annual Report. The following table summarizes our shares of restricted common stock that were delivered by certain employees upon vesting of equity awards to satisfy tax withholding requirements for the fourth quarter of fiscal 2021 (in thousands except for price per share): Total Number of Shares Approximate Dollar Value of Average Price per Delivered to Satisfy Tax Shares Delivered to Satisfy Tax Period Share Delivered Withholding Requirements Withholding Requirements November 2 - November 29, 2020 $ — — $ — November 30 - December 27, 2020 $ 22.47 186 $ 4,177 December 28 - January 31, 2021 $ — — $ — 33

Annua lReport Page 32 Page 34

Annua lReport Page 32 Page 34