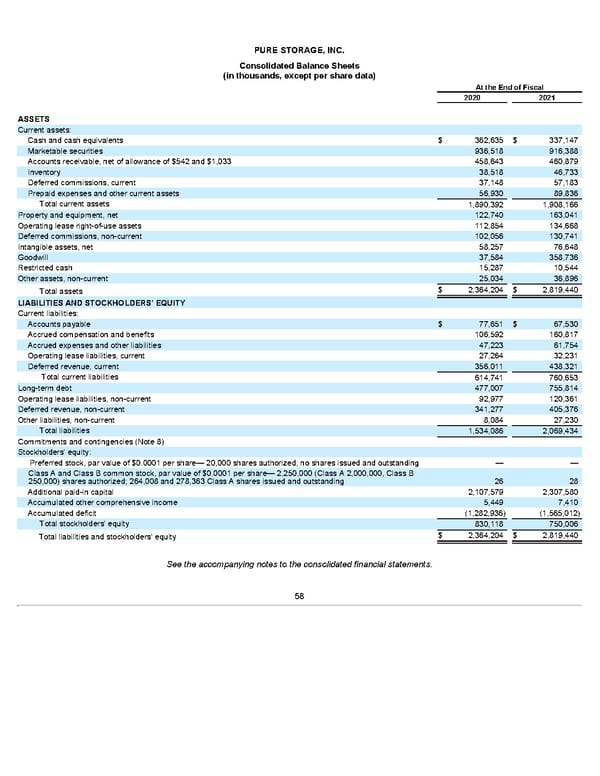

PURE STORAGE, INC. Consolidated Balance Sheets (in thousands, except per share data) At the End of Fiscal 2020 2021 ASSETS Current assets: Cash and cash equivalents $ 362,635 $ 337,147 Marketable securities 936,518 916,388 Accounts receivable, net of allowance of $542 and $1,033 458,643 460,879 Inventory 38,518 46,733 Deferred commissions, current 37,148 57,183 Prepaid expenses and other current assets 56,930 89,836 Total current assets 1,890,392 1,908,166 Property and equipment, net 122,740 163,041 Operating lease right-of-use assets 112,854 134,668 Deferred commissions, non-current 102,056 130,741 Intangible assets, net 58,257 76,648 Goodwill 37,584 358,736 Restricted cash 15,287 10,544 Other assets, non-current 25,034 36,896 $ 2,364,204 $ 2,819,440 Total assets LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 77,651 $ 67,530 Accrued compensation and benefits 106,592 160,817 Accrued expenses and other liabilities 47,223 61,754 Operating lease liabilities, current 27,264 32,231 Deferred revenue, current 356,011 438,321 Total current liabilities 614,741 760,653 Long-term debt 477,007 755,814 Operating lease liabilities, non-current 92,977 120,361 Deferred revenue, non-current 341,277 405,376 Other liabilities, non-current 8,084 27,230 Total liabilities 1,534,086 2,069,434 Commitments and contingencies (Note 8) Stockholders’ equity: Preferred stock, par value of $0.0001 per share— 20,000 shares authorized; no shares issued and outstanding — — Class A and Class B common stock, par value of $0.0001 per share— 2,250,000 (Class A 2,000,000, Class B 250,000) shares authorized; 264,008 and 278,363 Class A shares issued and outstanding 26 28 Additional paid-in capital 2,107,579 2,307,580 Accumulated other comprehensive income 5,449 7,410 Accumulated deficit (1,282,936) (1,565,012) Total stockholders’ equity 830,118 750,006 $ 2,364,204 $ 2,819,440 Total liabilities and stockholders’ equity See the accompanying notes to the consolidated financial statements. 58

Annua lReport Page 57 Page 59

Annua lReport Page 57 Page 59