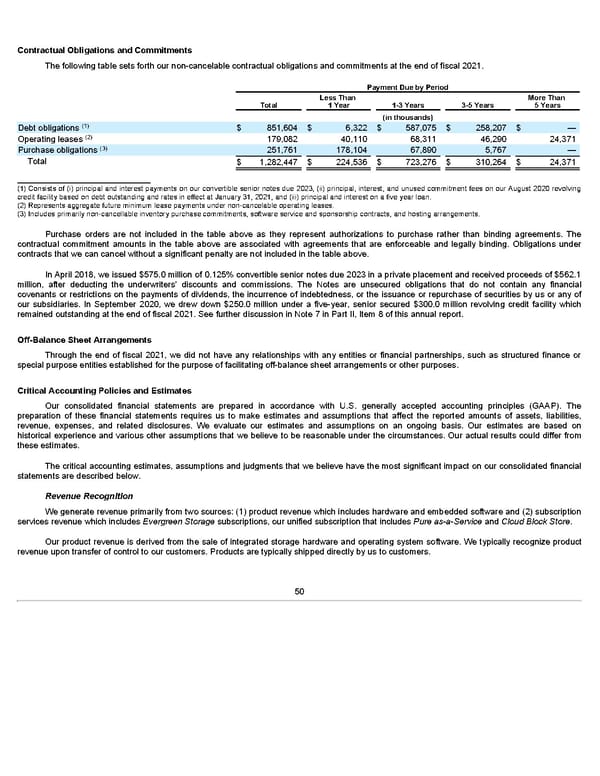

Contractual Obligations and Commitments The following table sets forth our non-cancelable contractual obligations and commitments at the end of fiscal 2021. Payment Due by Period Less Than More Than Total 1 Year 1-3 Years 3-5 Years 5 Years (in thousands) (1) Debt obligations $ 851,604 $ 6,322 $ 587,075 $ 258,207 $ — (2) Operating leases 179,082 40,110 68,311 46,290 24,371 (3) Purchase obligations 251,761 178,104 67,890 5,767 — Total $ 1,282,447 $ 224,536 $ 723,276 $ 310,264 $ 24,371 _________________________________ (1) Consists of (i) principal and interest payments on our convertible senior notes due 2023, (ii) principal, interest, and unused commitment fees on our August 2020 revolving credit facility based on debt outstanding and rates in effect at January 31, 2021, and (iii) principal and interest on a five year loan. (2) Represents aggregate future minimum lease payments under non-cancelable operating leases. (3) Includes primarily non-cancellable inventory purchase commitments, software service and sponsorship contracts, and hosting arrangements. Purchase orders are not included in the table above as they represent authorizations to purchase rather than binding agreements. The contractual commitment amounts in the table above are associated with agreements that are enforceable and legally binding. Obligations under contracts that we can cancel without a significant penalty are not included in the table above. In April 2018, we issued $575.0 million of 0.125% convertible senior notes due 2023 in a private placement and received proceeds of $562.1 million, after deducting the underwriters' discounts and commissions. The Notes are unsecured obligations that do not contain any financial covenants or restrictions on the payments of dividends, the incurrence of indebtedness, or the issuance or repurchase of securities by us or any of our subsidiaries. In September 2020, we drew down $250.0 million under a five-year, senior secured $300.0 million revolving credit facility which remained outstanding at the end of fiscal 2021. See further discussion in Note 7 in Part II, Item 8 of this annual report. Off-Balance Sheet Arrangements Through the end of fiscal 2021, we did not have any relationships with any entities or financial partnerships, such as structured finance or special purpose entities established for the purpose of facilitating off-balance sheet arrangements or other purposes. Critical Accounting Policies and Estimates Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP). The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosures. We evaluate our estimates and assumptions on an ongoing basis. Our estimates are based on historical experience and various other assumptions that we believe to be reasonable under the circumstances. Our actual results could differ from these estimates. The critical accounting estimates, assumptions and judgments that we believe have the most significant impact on our consolidated financial statements are described below. Revenue Recognition We generate revenue primarily from two sources: (1) product revenue which includes hardware and embedded software and (2) subscription services revenue which includes Evergreen Storage subscriptions, our unified subscription that includes Pure as-a-Service and Cloud Block Store. Our product revenue is derived from the sale of integrated storage hardware and operating system software. We typically recognize product revenue upon transfer of control to our customers. Products are typically shipped directly by us to customers. 50

Annua lReport Page 49 Page 51

Annua lReport Page 49 Page 51