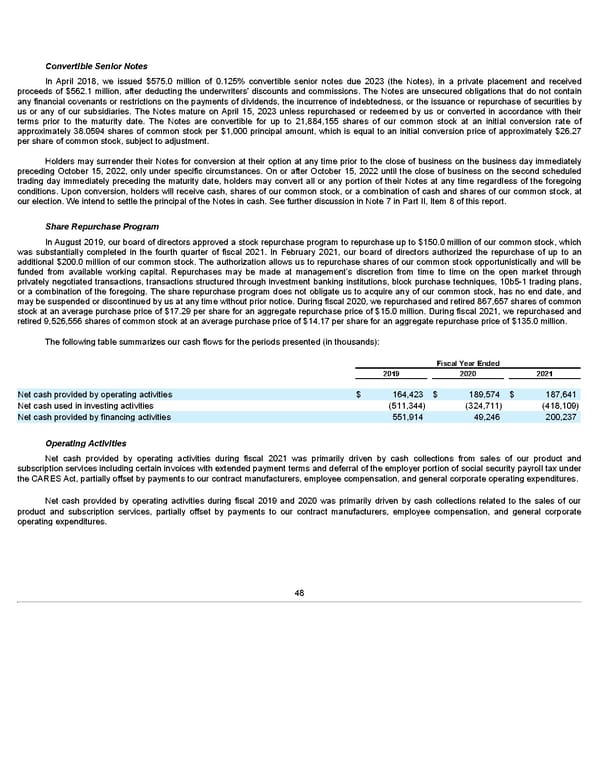

Convertible Senior Notes In April 2018, we issued $575.0 million of 0.125% convertible senior notes due 2023 (the Notes), in a private placement and received proceeds of $562.1 million, after deducting the underwriters' discounts and commissions. The Notes are unsecured obligations that do not contain any financial covenants or restrictions on the payments of dividends, the incurrence of indebtedness, or the issuance or repurchase of securities by us or any of our subsidiaries. The Notes mature on April 15, 2023 unless repurchased or redeemed by us or converted in accordance with their terms prior to the maturity date. The Notes are convertible for up to 21,884,155 shares of our common stock at an initial conversion rate of approximately 38.0594 shares of common stock per $1,000 principal amount, which is equal to an initial conversion price of approximately $26.27 per share of common stock, subject to adjustment. Holders may surrender their Notes for conversion at their option at any time prior to the close of business on the business day immediately preceding October 15, 2022, only under specific circumstances. On or after October 15, 2022 until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert all or any portion of their Notes at any time regardless of the foregoing conditions. Upon conversion, holders will receive cash, shares of our common stock, or a combination of cash and shares of our common stock, at our election. We intend to settle the principal of the Notes in cash. See further discussion in Note 7 in Part II, Item 8 of this report. Share Repurchase Program In August 2019, our board of directors approved a stock repurchase program to repurchase up to $150.0 million of our common stock, which was substantially completed in the fourth quarter of fiscal 2021. In February 2021, our board of directors authorized the repurchase of up to an additional $200.0 million of our common stock. The authorization allows us to repurchase shares of our common stock opportunistically and will be funded from available working capital. Repurchases may be made at management’s discretion from time to time on the open market through privately negotiated transactions, transactions structured through investment banking institutions, block purchase techniques, 10b5-1 trading plans, or a combination of the foregoing. The share repurchase program does not obligate us to acquire any of our common stock, has no end date, and may be suspended or discontinued by us at any time without prior notice. During fiscal 2020, we repurchased and retired 867,657 shares of common stock at an average purchase price of $17.29 per share for an aggregate repurchase price of $15.0 million. During fiscal 2021, we repurchased and retired 9,526,556 shares of common stock at an average purchase price of $14.17 per share for an aggregate repurchase price of $135.0 million. The following table summarizes our cash flows for the periods presented (in thousands): Fiscal Year Ended 2019 2020 2021 Net cash provided by operating activities $ 164,423 $ 189,574 $ 187,641 Net cash used in investing activities (511,344) (324,711) (418,109) Net cash provided by financing activities 551,914 49,246 200,237 Operating Activities Net cash provided by operating activities during fiscal 2021 was primarily driven by cash collections from sales of our product and subscription services including certain invoices with extended payment terms and deferral of the employer portion of social security payroll tax under the CARES Act, partially offset by payments to our contract manufacturers, employee compensation, and general corporate operating expenditures. Net cash provided by operating activities during fiscal 2019 and 2020 was primarily driven by cash collections related to the sales of our product and subscription services, partially offset by payments to our contract manufacturers, employee compensation, and general corporate operating expenditures. 48

Annua lReport Page 47 Page 49

Annua lReport Page 47 Page 49