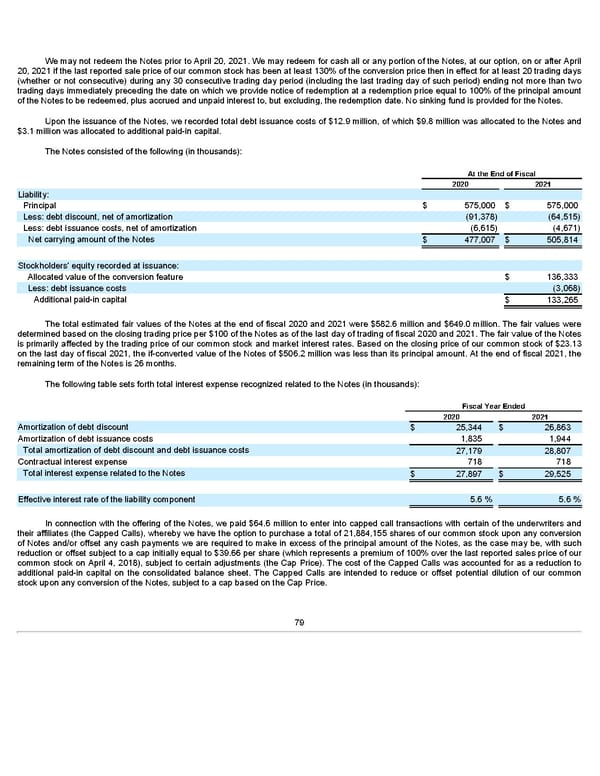

We may not redeem the Notes prior to April 20, 2021. We may redeem for cash all or any portion of the Notes, at our option, on or after April 20, 2021 if the last reported sale price of our common stock has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending not more than two trading days immediately preceding the date on which we provide notice of redemption at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date. No sinking fund is provided for the Notes. Upon the issuance of the Notes, we recorded total debt issuance costs of $12.9 million, of which $9.8 million was allocated to the Notes and $3.1 million was allocated to additional paid-in capital. The Notes consisted of the following (in thousands): At the End of Fiscal 2020 2021 Liability: Principal $ 575,000 $ 575,000 Less: debt discount, net of amortization (91,378) (64,515) Less: debt issuance costs, net of amortization (6,615) (4,671) Net carrying amount of the Notes $ 477,007 $ 505,814 Stockholders' equity recorded at issuance: Allocated value of the conversion feature $ 136,333 Less: debt issuance costs (3,068) Additional paid-in capital $ 133,265 The total estimated fair values of the Notes at the end of fiscal 2020 and 2021 were $582.6 million and $649.0 million. The fair values were determined based on the closing trading price per $100 of the Notes as of the last day of trading of fiscal 2020 and 2021. The fair value of the Notes is primarily affected by the trading price of our common stock and market interest rates. Based on the closing price of our common stock of $23.13 on the last day of fiscal 2021, the if-converted value of the Notes of $506.2 million was less than its principal amount. At the end of fiscal 2021, the remaining term of the Notes is 26 months. The following table sets forth total interest expense recognized related to the Notes (in thousands): Fiscal Year Ended 2020 2021 Amortization of debt discount $ 25,344 $ 26,863 Amortization of debt issuance costs 1,835 1,944 Total amortization of debt discount and debt issuance costs 27,179 28,807 Contractual interest expense 718 718 Total interest expense related to the Notes $ 27,897 $ 29,525 Effective interest rate of the liability component 5.6 % 5.6 % In connection with the offering of the Notes, we paid $64.6 million to enter into capped call transactions with certain of the underwriters and their affiliates (the Capped Calls), whereby we have the option to purchase a total of 21,884,155 shares of our common stock upon any conversion of Notes and/or offset any cash payments we are required to make in excess of the principal amount of the Notes, as the case may be, with such reduction or offset subject to a cap initially equal to $39.66 per share (which represents a premium of 100% over the last reported sales price of our common stock on April 4, 2018), subject to certain adjustments (the Cap Price). The cost of the Capped Calls was accounted for as a reduction to additional paid-in capital on the consolidated balance sheet. The Capped Calls are intended to reduce or offset potential dilution of our common stock upon any conversion of the Notes, subject to a cap based on the Cap Price. 79

Annua lReport Page 78 Page 80

Annua lReport Page 78 Page 80