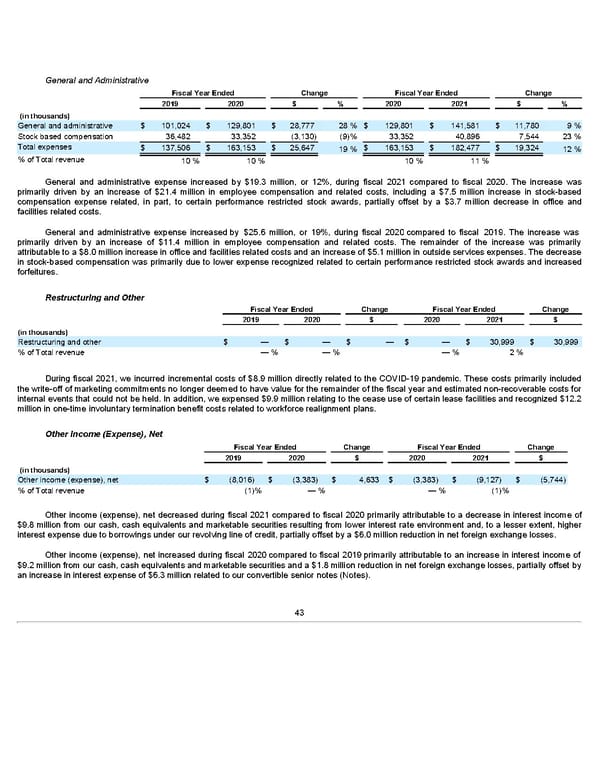

General and Administrative Fiscal Year Ended Change Fiscal Year Ended Change 2019 2020 $ % 2020 2021 $ % (in thousands) General and administrative $ 101,024 $ 129,801 $ 28,777 28 % $ 129,801 $ 141,581 $ 11,780 9 % Stock based compensation 36,482 33,352 (3,130) (9)% 33,352 40,896 7,544 23 % Total expenses $ 137,506 $ 163,153 $ 25,647 $ 163,153 $ 182,477 $ 19,324 19 % 12 % % of Total revenue 10 % 10 % 10 % 11 % General and administrative expense increased by $19.3 million, or 12%, during fiscal 2021 compared to fiscal 2020. The increase was primarily driven by an increase of $21.4 million in employee compensation and related costs, including a $7.5 million increase in stock-based compensation expense related, in part, to certain performance restricted stock awards, partially offset by a $3.7 million decrease in office and facilities related costs. General and administrative expense increased by $25.6 million, or 19%, during fiscal 2020 compared to fiscal 2019. The increase was primarily driven by an increase of $11.4 million in employee compensation and related costs. The remainder of the increase was primarily attributable to a $8.0 million increase in office and facilities related costs and an increase of $5.1 million in outside services expenses. The decrease in stock-based compensation was primarily due to lower expense recognized related to certain performance restricted stock awards and increased forfeitures. Restructuring and Other Fiscal Year Ended Change Fiscal Year Ended Change 2019 2020 $ 2020 2021 $ (in thousands) Restructuring and other $ — $ — $ — $ — $ 30,999 $ 30,999 % of Total revenue — % — % — % 2 % During fiscal 2021, we incurred incremental costs of $8.9 million directly related to the COVID-19 pandemic. These costs primarily included the write-off of marketing commitments no longer deemed to have value for the remainder of the fiscal year and estimated non-recoverable costs for internal events that could not be held. In addition, we expensed $9.9 million relating to the cease use of certain lease facilities and recognized $12.2 million in one-time involuntary termination benefit costs related to workforce realignment plans. Other Income (Expense), Net Fiscal Year Ended Change Fiscal Year Ended Change 2019 2020 $ 2020 2021 $ (in thousands) Other income (expense), net $ (8,016) $ (3,383) $ 4,633 $ (3,383) $ (9,127) $ (5,744) % of Total revenue (1)% — % — % (1)% Other income (expense), net decreased during fiscal 2021 compared to fiscal 2020 primarily attributable to a decrease in interest income of $9.8 million from our cash, cash equivalents and marketable securities resulting from lower interest rate environment and, to a lesser extent, higher interest expense due to borrowings under our revolving line of credit, partially offset by a $6.0 million reduction in net foreign exchange losses. Other income (expense), net increased during fiscal 2020 compared to fiscal 2019 primarily attributable to an increase in interest income of $9.2 million from our cash, cash equivalents and marketable securities and a $1.8 million reduction in net foreign exchange losses, partially offset by an increase in interest expense of $6.3 million related to our convertible senior notes (Notes). 43

Annua lReport Page 42 Page 44

Annua lReport Page 42 Page 44