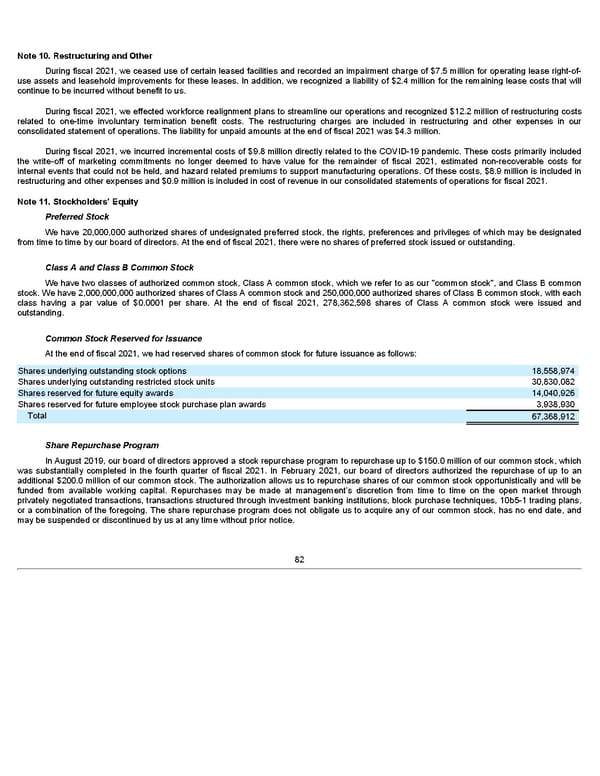

Note 10. Restructuring and Other During fiscal 2021, we ceased use of certain leased facilities and recorded an impairment charge of $7.5 million for operating lease right-of- use assets and leasehold improvements for these leases. In addition, we recognized a liability of $2.4 million for the remaining lease costs that will continue to be incurred without benefit to us. During fiscal 2021, we effected workforce realignment plans to streamline our operations and recognized $12.2 million of restructuring costs related to one-time involuntary termination benefit costs. The restructuring charges are included in restructuring and other expenses in our consolidated statement of operations. The liability for unpaid amounts at the end of fiscal 2021 was $4.3 million. During fiscal 2021, we incurred incremental costs of $9.8 million directly related to the COVID-19 pandemic. These costs primarily included the write-off of marketing commitments no longer deemed to have value for the remainder of fiscal 2021, estimated non-recoverable costs for internal events that could not be held, and hazard related premiums to support manufacturing operations. Of these costs, $8.9 million is included in restructuring and other expenses and $0.9 million is included in cost of revenue in our consolidated statements of operations for fiscal 2021. Note 11. Stockholders’ Equity Preferred Stock We have 20,000,000 authorized shares of undesignated preferred stock, the rights, preferences and privileges of which may be designated from time to time by our board of directors. At the end of fiscal 2021, there were no shares of preferred stock issued or outstanding. Class A and Class B Common Stock We have two classes of authorized common stock, Class A common stock, which we refer to as our "common stock", and Class B common stock. We have 2,000,000,000 authorized shares of Class A common stock and 250,000,000 authorized shares of Class B common stock, with each class having a par value of $0.0001 per share. At the end of fiscal 2021, 278,362,598 shares of Class A common stock were issued and outstanding. Common Stock Reserved for Issuance At the end of fiscal 2021, we had reserved shares of common stock for future issuance as follows: Shares underlying outstanding stock options 18,558,974 Shares underlying outstanding restricted stock units 30,830,082 Shares reserved for future equity awards 14,040,926 Shares reserved for future employee stock purchase plan awards 3,938,930 Total 67,368,912 Share Repurchase Program In August 2019, our board of directors approved a stock repurchase program to repurchase up to $150.0 million of our common stock, which was substantially completed in the fourth quarter of fiscal 2021. In February 2021, our board of directors authorized the repurchase of up to an additional $200.0 million of our common stock. The authorization allows us to repurchase shares of our common stock opportunistically and will be funded from available working capital. Repurchases may be made at management’s discretion from time to time on the open market through privately negotiated transactions, transactions structured through investment banking institutions, block purchase techniques, 10b5-1 trading plans, or a combination of the foregoing. The share repurchase program does not obligate us to acquire any of our common stock, has no end date, and may be suspended or discontinued by us at any time without prior notice. 82

Annua lReport Page 81 Page 83

Annua lReport Page 81 Page 83