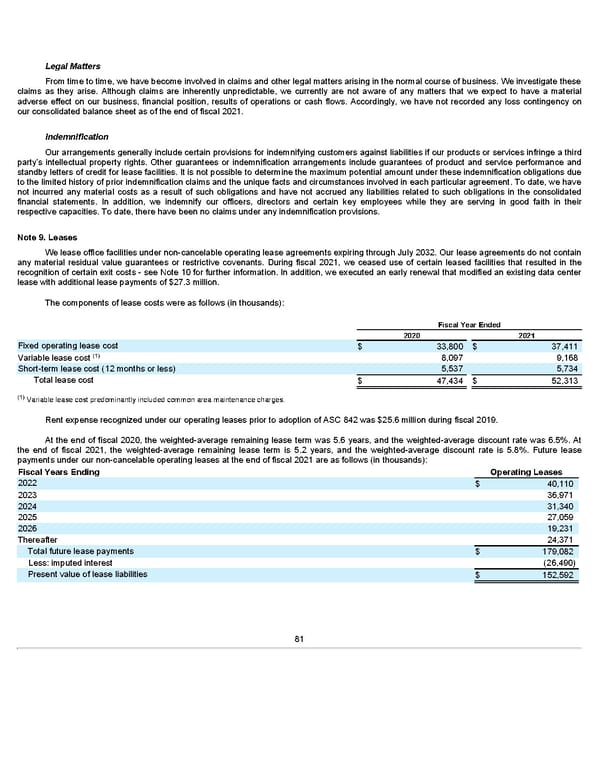

Legal Matters From time to time, we have become involved in claims and other legal matters arising in the normal course of business. We investigate these claims as they arise. Although claims are inherently unpredictable, we currently are not aware of any matters that we expect to have a material adverse effect on our business, financial position, results of operations or cash flows. Accordingly, we have not recorded any loss contingency on our consolidated balance sheet as of the end of fiscal 2021. Indemnification Our arrangements generally include certain provisions for indemnifying customers against liabilities if our products or services infringe a third party’s intellectual property rights. Other guarantees or indemnification arrangements include guarantees of product and service performance and standby letters of credit for lease facilities. It is not possible to determine the maximum potential amount under these indemnification obligations due to the limited history of prior indemnification claims and the unique facts and circumstances involved in each particular agreement. To date, we have not incurred any material costs as a result of such obligations and have not accrued any liabilities related to such obligations in the consolidated financial statements. In addition, we indemnify our officers, directors and certain key employees while they are serving in good faith in their respective capacities. To date, there have been no claims under any indemnification provisions. Note 9. Leases We lease office facilities under non-cancelable operating lease agreements expiring through July 2032. Our lease agreements do not contain any material residual value guarantees or restrictive covenants. During fiscal 2021, we ceased use of certain leased facilities that resulted in the recognition of certain exit costs - see Note 10 for further information. In addition, we executed an early renewal that modified an existing data center lease with additional lease payments of $27.3 million. The components of lease costs were as follows (in thousands): Fiscal Year Ended 2020 2021 Fixed operating lease cost $ 33,800 $ 37,411 (1) Variable lease cost 8,097 9,168 Short-term lease cost (12 months or less) 5,537 5,734 Total lease cost $ 47,434 $ 52,313 (1) Variable lease cost predominantly included common area maintenance charges. Rent expense recognized under our operating leases prior to adoption of ASC 842 was $25.6 million during fiscal 2019. At the end of fiscal 2020, the weighted-average remaining lease term was 5.6 years, and the weighted-average discount rate was 6.5%. At the end of fiscal 2021, the weighted-average remaining lease term is 5.2 years, and the weighted-average discount rate is 5.8%. Future lease payments under our non-cancelable operating leases at the end of fiscal 2021 are as follows (in thousands): Fiscal Years Ending Operating Leases 2022 $ 40,110 2023 36,971 2024 31,340 2025 27,059 2026 19,231 Thereafter 24,371 Total future lease payments $ 179,082 Less: imputed interest (26,490) Present value of lease liabilities $ 152,592 81

Annua lReport Page 80 Page 82

Annua lReport Page 80 Page 82