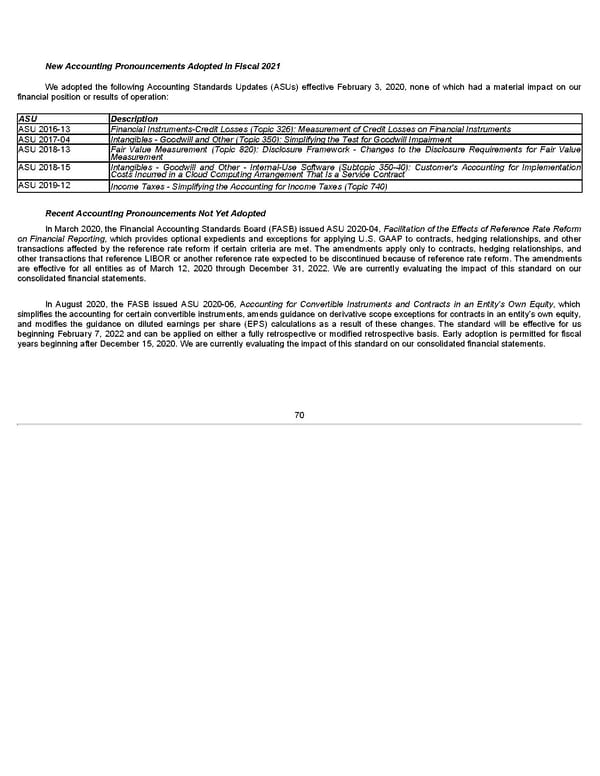

New Accounting Pronouncements Adopted in Fiscal 2021 We adopted the following Accounting Standards Updates (ASUs) effective February 3, 2020, none of which had a material impact on our financial position or results of operation: ASU Description ASU 2016-13 Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments ASU 2017-04 Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment ASU 2018-13 Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement ASU 2018-15 Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer's Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract ASU 2019-12 Income Taxes - Simplifying the Accounting for Income Taxes (Topic 740) Recent Accounting Pronouncements Not Yet Adopted In March 2020, the Financial Accounting Standards Board (FASB) issued ASU 2020-04, Facilitation of the Effects of Reference Rate Reform on Financial Reporting, which provides optional expedients and exceptions for applying U.S. GAAP to contracts, hedging relationships, and other transactions affected by the reference rate reform if certain criteria are met. The amendments apply only to contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. The amendments are effective for all entities as of March 12, 2020 through December 31, 2022. We are currently evaluating the impact of this standard on our consolidated financial statements. In August 2020, the FASB issued ASU 2020-06, Accounting for Convertible Instruments and Contracts in an Entity's Own Equity, which simplifies the accounting for certain convertible instruments, amends guidance on derivative scope exceptions for contracts in an entity's own equity, and modifies the guidance on diluted earnings per share (EPS) calculations as a result of these changes. The standard will be effective for us beginning February 7, 2022 and can be applied on either a fully retrospective or modified retrospective basis. Early adoption is permitted for fiscal years beginning after December 15, 2020. We are currently evaluating the impact of this standard on our consolidated financial statements. 70

Annua lReport Page 69 Page 71

Annua lReport Page 69 Page 71