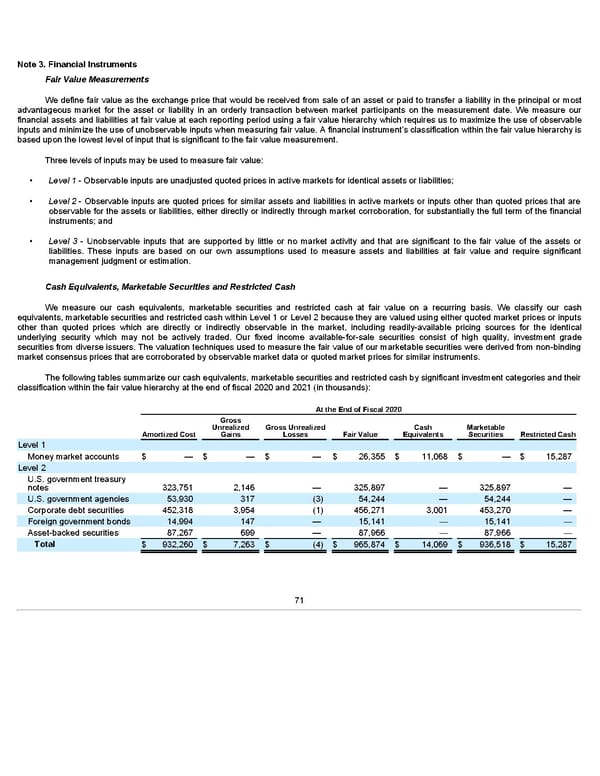

Note 3. Financial Instruments Fair Value Measurements We define fair value as the exchange price that would be received from sale of an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. We measure our financial assets and liabilities at fair value at each reporting period using a fair value hierarchy which requires us to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s classification within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Three levels of inputs may be used to measure fair value: • Level 1 - Observable inputs are unadjusted quoted prices in active markets for identical assets or liabilities; • Level 2 - Observable inputs are quoted prices for similar assets and liabilities in active markets or inputs other than quoted prices that are observable for the assets or liabilities, either directly or indirectly through market corroboration, for substantially the full term of the financial instruments; and • Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. These inputs are based on our own assumptions used to measure assets and liabilities at fair value and require significant management judgment or estimation. Cash Equivalents, Marketable Securities and Restricted Cash We measure our cash equivalents, marketable securities and restricted cash at fair value on a recurring basis. We classify our cash equivalents, marketable securities and restricted cash within Level 1 or Level 2 because they are valued using either quoted market prices or inputs other than quoted prices which are directly or indirectly observable in the market, including readily-available pricing sources for the identical underlying security which may not be actively traded. Our fixed income available-for-sale securities consist of high quality, investment grade securities from diverse issuers. The valuation techniques used to measure the fair value of our marketable securities were derived from non-binding market consensus prices that are corroborated by observable market data or quoted market prices for similar instruments. The following tables summarize our cash equivalents, marketable securities and restricted cash by significant investment categories and their classification within the fair value hierarchy at the end of fiscal 2020 and 2021 (in thousands): At the End of Fiscal 2020 Gross Unrealized Gross Unrealized Cash Marketable Amortized Cost Gains Losses Fair Value Equivalents Securities Restricted Cash Level 1 Money market accounts $ — $ — $ — $ 26,355 $ 11,068 $ — $ 15,287 Level 2 U.S. government treasury notes 323,751 2,146 — 325,897 — 325,897 — U.S. government agencies 53,930 317 (3) 54,244 — 54,244 — Corporate debt securities 452,318 3,954 (1) 456,271 3,001 453,270 — Foreign government bonds 14,994 147 — 15,141 — 15,141 — Asset-backed securities 87,267 699 — 87,966 — 87,966 — Total $ 932,260 $ 7,263 $ (4) $ 965,874 $ 14,069 $ 936,518 $ 15,287 71

Annua lReport Page 70 Page 72

Annua lReport Page 70 Page 72