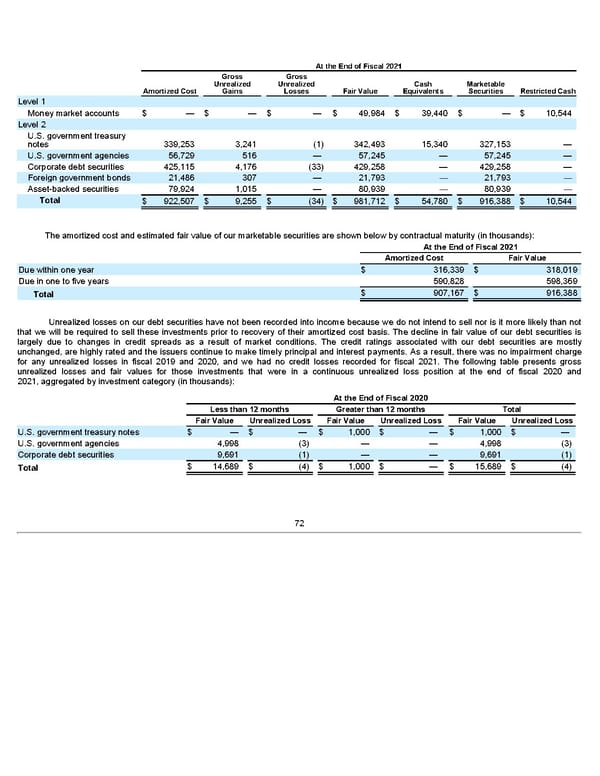

At the End of Fiscal 2021 Gross Gross Unrealized Unrealized Cash Marketable Amortized Cost Gains Losses Fair Value Equivalents Securities Restricted Cash Level 1 Money market accounts $ — $ — $ — $ 49,984 $ 39,440 $ — $ 10,544 Level 2 U.S. government treasury notes 339,253 3,241 (1) 342,493 15,340 327,153 — U.S. government agencies 56,729 516 — 57,245 — 57,245 — Corporate debt securities 425,115 4,176 (33) 429,258 — 429,258 — Foreign government bonds 21,486 307 — 21,793 — 21,793 — Asset-backed securities 79,924 1,015 — 80,939 — 80,939 — Total $ 922,507 $ 9,255 $ (34) $ 981,712 $ 54,780 $ 916,388 $ 10,544 The amortized cost and estimated fair value of our marketable securities are shown below by contractual maturity (in thousands): At the End of Fiscal 2021 Amortized Cost Fair Value Due within one year $ 316,339 $ 318,019 Due in one to five years 590,828 598,369 $ 907,167 $ 916,388 Total Unrealized losses on our debt securities have not been recorded into income because we do not intend to sell nor is it more likely than not that we will be required to sell these investments prior to recovery of their amortized cost basis. The decline in fair value of our debt securities is largely due to changes in credit spreads as a result of market conditions. The credit ratings associated with our debt securities are mostly unchanged, are highly rated and the issuers continue to make timely principal and interest payments. As a result, there was no impairment charge for any unrealized losses in fiscal 2019 and 2020, and we had no credit losses recorded for fiscal 2021. The following table presents gross unrealized losses and fair values for those investments that were in a continuous unrealized loss position at the end of fiscal 2020 and 2021, aggregated by investment category (in thousands): At the End of Fiscal 2020 Less than 12 months Greater than 12 months Total Fair Value Unrealized Loss Fair Value Unrealized Loss Fair Value Unrealized Loss U.S. government treasury notes $ — $ — $ 1,000 $ — $ 1,000 $ — U.S. government agencies 4,998 (3) — — 4,998 (3) Corporate debt securities 9,691 (1) — — 9,691 (1) $ 14,689 $ (4) $ 1,000 $ — $ 15,689 $ (4) Total 72

Annua lReport Page 71 Page 73

Annua lReport Page 71 Page 73