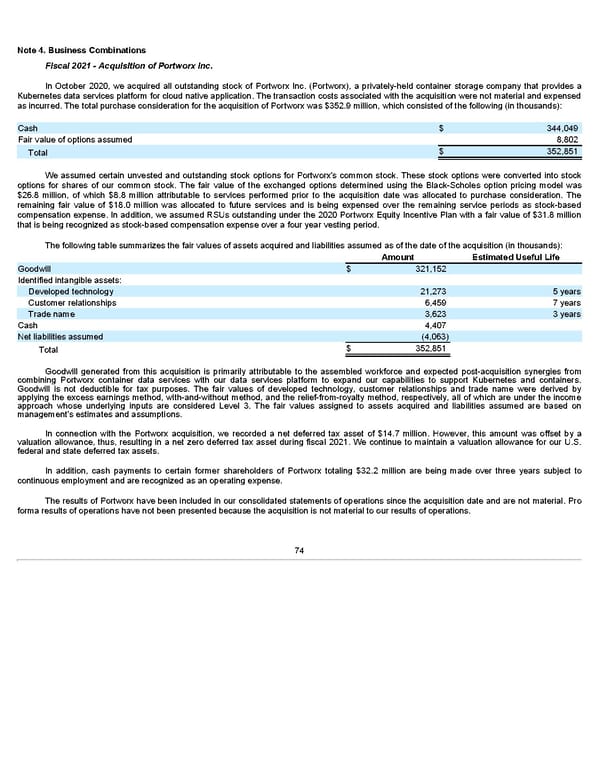

Note 4. Business Combinations Fiscal 2021 - Acquisition of Portworx Inc. In October 2020, we acquired all outstanding stock of Portworx Inc. (Portworx), a privately-held container storage company that provides a Kubernetes data services platform for cloud native application. The transaction costs associated with the acquisition were not material and expensed as incurred. The total purchase consideration for the acquisition of Portworx was $352.9 million, which consisted of the following (in thousands): Cash $ 344,049 Fair value of options assumed 8,802 $ 352,851 Total We assumed certain unvested and outstanding stock options for Portworx's common stock. These stock options were converted into stock options for shares of our common stock. The fair value of the exchanged options determined using the Black-Scholes option pricing model was $26.8 million, of which $8.8 million attributable to services performed prior to the acquisition date was allocated to purchase consideration. The remaining fair value of $18.0 million was allocated to future services and is being expensed over the remaining service periods as stock-based compensation expense. In addition, we assumed RSUs outstanding under the 2020 Portworx Equity Incentive Plan with a fair value of $31.8 million that is being recognized as stock-based compensation expense over a four year vesting period. The following table summarizes the fair values of assets acquired and liabilities assumed as of the date of the acquisition (in thousands): Amount Estimated Useful Life Goodwill $ 321,152 Identified intangible assets: Developed technology 21,273 5 years Customer relationships 6,459 7 years Trade name 3,623 3 years Cash 4,407 Net liabilities assumed (4,063) $ 352,851 Total Goodwill generated from this acquisition is primarily attributable to the assembled workforce and expected post-acquisition synergies from combining Portworx container data services with our data services platform to expand our capabilities to support Kubernetes and containers. Goodwill is not deductible for tax purposes. The fair values of developed technology, customer relationships and trade name were derived by applying the excess earnings method, with-and-without method, and the relief-from-royalty method, respectively, all of which are under the income approach whose underlying inputs are considered Level 3. The fair values assigned to assets acquired and liabilities assumed are based on management's estimates and assumptions. In connection with the Portworx acquisition, we recorded a net deferred tax asset of $14.7 million. However, this amount was offset by a valuation allowance, thus, resulting in a net zero deferred tax asset during fiscal 2021. We continue to maintain a valuation allowance for our U.S. federal and state deferred tax assets. In addition, cash payments to certain former shareholders of Portworx totaling $32.2 million are being made over three years subject to continuous employment and are recognized as an operating expense. The results of Portworx have been included in our consolidated statements of operations since the acquisition date and are not material. Pro forma results of operations have not been presented because the acquisition is not material to our results of operations. 74

Annua lReport Page 73 Page 75

Annua lReport Page 73 Page 75