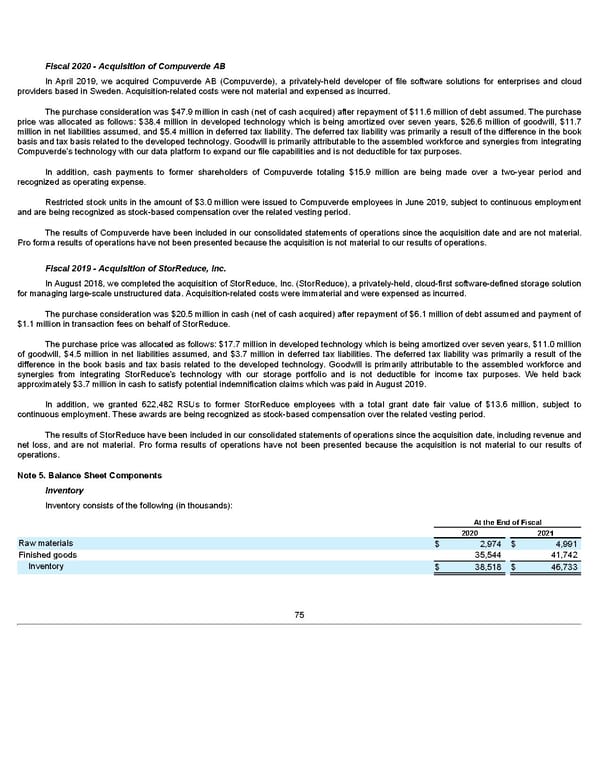

Fiscal 2020 - Acquisition of Compuverde AB In April 2019, we acquired Compuverde AB (Compuverde), a privately-held developer of file software solutions for enterprises and cloud providers based in Sweden. Acquisition-related costs were not material and expensed as incurred. The purchase consideration was $47.9 million in cash (net of cash acquired) after repayment of $11.6 million of debt assumed. The purchase price was allocated as follows: $38.4 million in developed technology which is being amortized over seven years, $26.6 million of goodwill, $11.7 million in net liabilities assumed, and $5.4 million in deferred tax liability. The deferred tax liability was primarily a result of the difference in the book basis and tax basis related to the developed technology. Goodwill is primarily attributable to the assembled workforce and synergies from integrating Compuverde's technology with our data platform to expand our file capabilities and is not deductible for tax purposes. In addition, cash payments to former shareholders of Compuverde totaling $15.9 million are being made over a two-year period and recognized as operating expense. Restricted stock units in the amount of $3.0 million were issued to Compuverde employees in June 2019, subject to continuous employment and are being recognized as stock-based compensation over the related vesting period. The results of Compuverde have been included in our consolidated statements of operations since the acquisition date and are not material. Pro forma results of operations have not been presented because the acquisition is not material to our results of operations. Fiscal 2019 - Acquisition of StorReduce, Inc. In August 2018, we completed the acquisition of StorReduce, Inc. (StorReduce), a privately-held, cloud-first software-defined storage solution for managing large-scale unstructured data. Acquisition-related costs were immaterial and were expensed as incurred. The purchase consideration was $20.5 million in cash (net of cash acquired) after repayment of $6.1 million of debt assumed and payment of $1.1 million in transaction fees on behalf of StorReduce. The purchase price was allocated as follows: $17.7 million in developed technology which is being amortized over seven years, $11.0 million of goodwill, $4.5 million in net liabilities assumed, and $3.7 million in deferred tax liabilities. The deferred tax liability was primarily a result of the difference in the book basis and tax basis related to the developed technology. Goodwill is primarily attributable to the assembled workforce and synergies from integrating StorReduce's technology with our storage portfolio and is not deductible for income tax purposes. We held back approximately $3.7 million in cash to satisfy potential indemnification claims which was paid in August 2019. In addition, we granted 622,482 RSUs to former StorReduce employees with a total grant date fair value of $13.6 million, subject to continuous employment. These awards are being recognized as stock-based compensation over the related vesting period. The results of StorReduce have been included in our consolidated statements of operations since the acquisition date, including revenue and net loss, and are not material. Pro forma results of operations have not been presented because the acquisition is not material to our results of operations. Note 5. Balance Sheet Components Inventory Inventory consists of the following (in thousands): At the End of Fiscal 2020 2021 Raw materials $ 2,974 $ 4,991 Finished goods 35,544 41,742 Inventory $ 38,518 $ 46,733 75

Annua lReport Page 74 Page 76

Annua lReport Page 74 Page 76