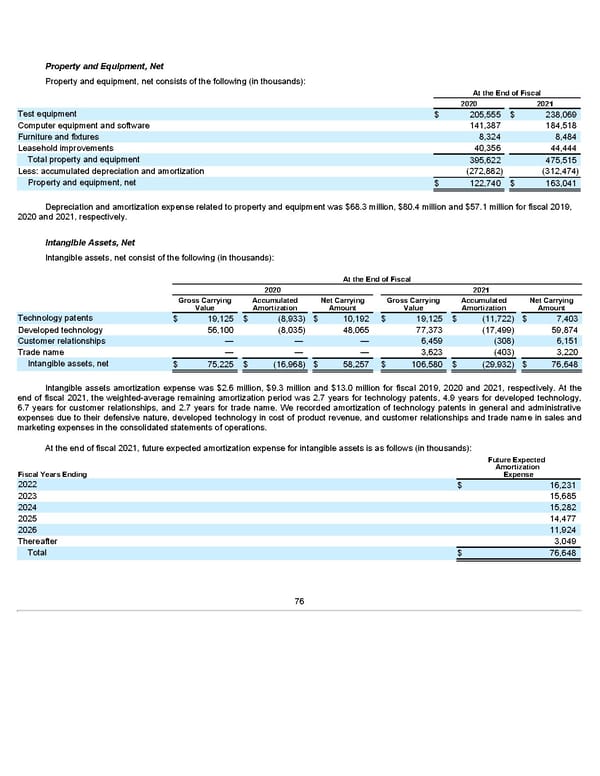

Property and Equipment, Net Property and equipment, net consists of the following (in thousands): At the End of Fiscal 2020 2021 Test equipment $ 205,555 $ 238,069 Computer equipment and software 141,387 184,518 Furniture and fixtures 8,324 8,484 Leasehold improvements 40,356 44,444 Total property and equipment 395,622 475,515 Less: accumulated depreciation and amortization (272,882) (312,474) Property and equipment, net $ 122,740 $ 163,041 Depreciation and amortization expense related to property and equipment was $68.3 million, $80.4 million and $57.1 million for fiscal 2019, 2020 and 2021, respectively. Intangible Assets, Net Intangible assets, net consist of the following (in thousands): At the End of Fiscal 2020 2021 Gross Carrying Accumulated Net Carrying Gross Carrying Accumulated Net Carrying Value Amortization Amount Value Amortization Amount Technology patents $ 19,125 $ (8,933) $ 10,192 $ 19,125 $ (11,722) $ 7,403 Developed technology 56,100 (8,035) 48,065 77,373 (17,499) 59,874 Customer relationships — — — 6,459 (308) 6,151 Trade name — — — 3,623 (403) 3,220 Intangible assets, net $ 75,225 $ (16,968) $ 58,257 $ 106,580 $ (29,932) $ 76,648 Intangible assets amortization expense was $2.6 million, $9.3 million and $13.0 million for fiscal 2019, 2020 and 2021, respectively. At the end of fiscal 2021, the weighted-average remaining amortization period was 2.7 years for technology patents, 4.9 years for developed technology, 6.7 years for customer relationships, and 2.7 years for trade name. We recorded amortization of technology patents in general and administrative expenses due to their defensive nature, developed technology in cost of product revenue, and customer relationships and trade name in sales and marketing expenses in the consolidated statements of operations. At the end of fiscal 2021, future expected amortization expense for intangible assets is as follows (in thousands): Future Expected Amortization Fiscal Years Ending Expense 2022 $ 16,231 2023 15,685 2024 15,282 2025 14,477 2026 11,924 Thereafter 3,049 Total $ 76,648 76

Annua lReport Page 75 Page 77

Annua lReport Page 75 Page 77