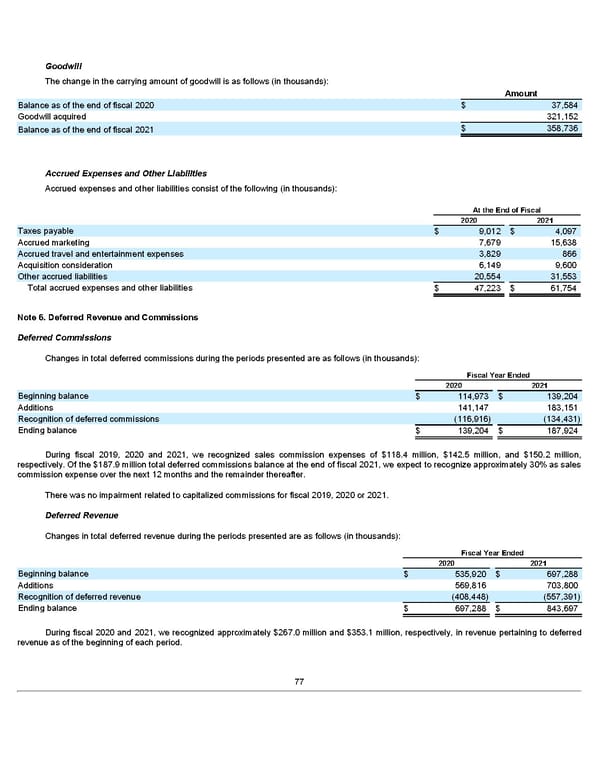

Goodwill The change in the carrying amount of goodwill is as follows (in thousands): Amount Balance as of the end of fiscal 2020 $ 37,584 Goodwill acquired 321,152 $ 358,736 Balance as of the end of fiscal 2021 Accrued Expenses and Other Liabilities Accrued expenses and other liabilities consist of the following (in thousands): At the End of Fiscal 2020 2021 Taxes payable $ 9,012 $ 4,097 Accrued marketing 7,679 15,638 Accrued travel and entertainment expenses 3,829 866 Acquisition consideration 6,149 9,600 Other accrued liabilities 20,554 31,553 Total accrued expenses and other liabilities $ 47,223 $ 61,754 Note 6. Deferred Revenue and Commissions Deferred Commissions Changes in total deferred commissions during the periods presented are as follows (in thousands): Fiscal Year Ended 2020 2021 Beginning balance $ 114,973 $ 139,204 Additions 141,147 183,151 Recognition of deferred commissions (116,916) (134,431) Ending balance $ 139,204 $ 187,924 During fiscal 2019, 2020 and 2021, we recognized sales commission expenses of $118.4 million, $142.5 million, and $150.2 million, respectively. Of the $187.9 million total deferred commissions balance at the end of fiscal 2021, we expect to recognize approximately 30% as sales commission expense over the next 12 months and the remainder thereafter. There was no impairment related to capitalized commissions for fiscal 2019, 2020 or 2021. Deferred Revenue Changes in total deferred revenue during the periods presented are as follows (in thousands): Fiscal Year Ended 2020 2021 Beginning balance $ 535,920 $ 697,288 Additions 569,816 703,800 Recognition of deferred revenue (408,448) (557,391) Ending balance $ 697,288 $ 843,697 During fiscal 2020 and 2021, we recognized approximately $267.0 million and $353.1 million, respectively, in revenue pertaining to deferred revenue as of the beginning of each period. 77

Annua lReport Page 76 Page 78

Annua lReport Page 76 Page 78