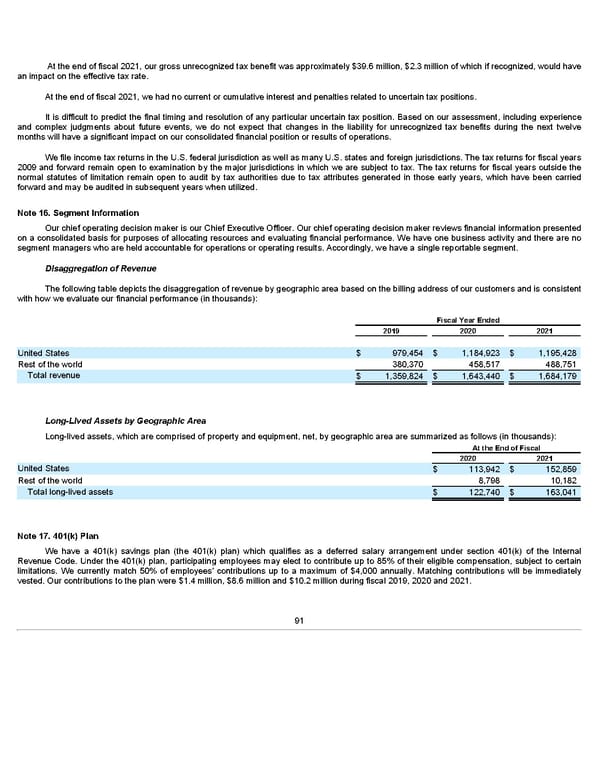

At the end of fiscal 2021, our gross unrecognized tax benefit was approximately $39.6 million, $2.3 million of which if recognized, would have an impact on the effective tax rate. At the end of fiscal 2021, we had no current or cumulative interest and penalties related to uncertain tax positions. It is difficult to predict the final timing and resolution of any particular uncertain tax position. Based on our assessment, including experience and complex judgments about future events, we do not expect that changes in the liability for unrecognized tax benefits during the next twelve months will have a significant impact on our consolidated financial position or results of operations. We file income tax returns in the U.S. federal jurisdiction as well as many U.S. states and foreign jurisdictions. The tax returns for fiscal years 2009 and forward remain open to examination by the major jurisdictions in which we are subject to tax. The tax returns for fiscal years outside the normal statutes of limitation remain open to audit by tax authorities due to tax attributes generated in those early years, which have been carried forward and may be audited in subsequent years when utilized. Note 16. Segment Information Our chief operating decision maker is our Chief Executive Officer. Our chief operating decision maker reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. We have one business activity and there are no segment managers who are held accountable for operations or operating results. Accordingly, we have a single reportable segment. Disaggregation of Revenue The following table depicts the disaggregation of revenue by geographic area based on the billing address of our customers and is consistent with how we evaluate our financial performance (in thousands): Fiscal Year Ended 2019 2020 2021 United States $ 979,454 $ 1,184,923 $ 1,195,428 Rest of the world 380,370 458,517 488,751 Total revenue $ 1,359,824 $ 1,643,440 $ 1,684,179 Long-Lived Assets by Geographic Area Long-lived assets, which are comprised of property and equipment, net, by geographic area are summarized as follows (in thousands): At the End of Fiscal 2020 2021 United States $ 113,942 $ 152,859 Rest of the world 8,798 10,182 Total long-lived assets $ 122,740 $ 163,041 Note 17. 401(k) Plan We have a 401(k) savings plan (the 401(k) plan) which qualifies as a deferred salary arrangement under section 401(k) of the Internal Revenue Code. Under the 401(k) plan, participating employees may elect to contribute up to 85% of their eligible compensation, subject to certain limitations. We currently match 50% of employees' contributions up to a maximum of $4,000 annually. Matching contributions will be immediately vested. Our contributions to the plan were $1.4 million, $8.6 million and $10.2 million during fiscal 2019, 2020 and 2021. 91

Annua lReport Page 90 Page 92

Annua lReport Page 90 Page 92