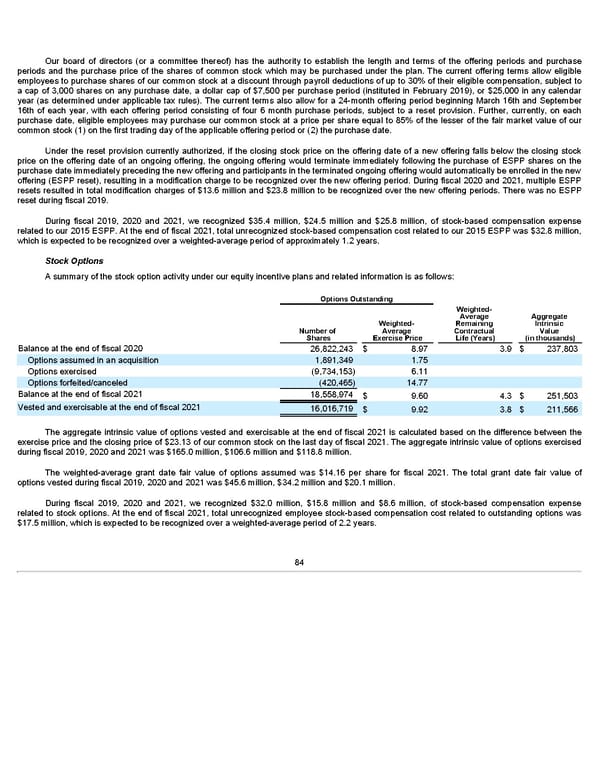

Our board of directors (or a committee thereof) has the authority to establish the length and terms of the offering periods and purchase periods and the purchase price of the shares of common stock which may be purchased under the plan. The current offering terms allow eligible employees to purchase shares of our common stock at a discount through payroll deductions of up to 30% of their eligible compensation, subject to a cap of 3,000 shares on any purchase date, a dollar cap of $7,500 per purchase period (instituted in February 2019), or $25,000 in any calendar year (as determined under applicable tax rules). The current terms also allow for a 24-month offering period beginning March 16th and September 16th of each year, with each offering period consisting of four 6 month purchase periods, subject to a reset provision. Further, currently, on each purchase date, eligible employees may purchase our common stock at a price per share equal to 85% of the lesser of the fair market value of our common stock (1) on the first trading day of the applicable offering period or (2) the purchase date. Under the reset provision currently authorized, if the closing stock price on the offering date of a new offering falls below the closing stock price on the offering date of an ongoing offering, the ongoing offering would terminate immediately following the purchase of ESPP shares on the purchase date immediately preceding the new offering and participants in the terminated ongoing offering would automatically be enrolled in the new offering (ESPP reset), resulting in a modification charge to be recognized over the new offering period. During fiscal 2020 and 2021, multiple ESPP resets resulted in total modification charges of $13.6 million and $23.8 million to be recognized over the new offering periods. There was no ESPP reset during fiscal 2019. During fiscal 2019, 2020 and 2021, we recognized $35.4 million, $24.5 million and $25.8 million, of stock-based compensation expense related to our 2015 ESPP. At the end of fiscal 2021, total unrecognized stock-based compensation cost related to our 2015 ESPP was $32.8 million, which is expected to be recognized over a weighted-average period of approximately 1.2 years. Stock Options A summary of the stock option activity under our equity incentive plans and related information is as follows: Options Outstanding Weighted- Average Aggregate Weighted- Remaining Intrinsic Number of Average Contractual Value Shares Exercise Price Life (Years) (in thousands) Balance at the end of fiscal 2020 26,822,243 $ 8.97 3.9 $ 237,803 Options assumed in an acquisition 1,891,349 1.75 Options exercised (9,734,153) 6.11 Options forfeited/canceled (420,465) 14.77 Balance at the end of fiscal 2021 18,558,974 $ 9.60 4.3 $ 251,503 Vested and exercisable at the end of fiscal 2021 16,016,719 $ 9.92 3.8 $ 211,566 The aggregate intrinsic value of options vested and exercisable at the end of fiscal 2021 is calculated based on the difference between the exercise price and the closing price of $23.13 of our common stock on the last day of fiscal 2021. The aggregate intrinsic value of options exercised during fiscal 2019, 2020 and 2021 was $165.0 million, $106.6 million and $118.8 million. The weighted-average grant date fair value of options assumed was $14.16 per share for fiscal 2021. The total grant date fair value of options vested during fiscal 2019, 2020 and 2021 was $45.6 million, $34.2 million and $20.1 million. During fiscal 2019, 2020 and 2021, we recognized $32.0 million, $15.8 million and $8.6 million, of stock-based compensation expense related to stock options. At the end of fiscal 2021, total unrecognized employee stock-based compensation cost related to outstanding options was $17.5 million, which is expected to be recognized over a weighted-average period of 2.2 years. 84

Annua lReport Page 83 Page 85

Annua lReport Page 83 Page 85