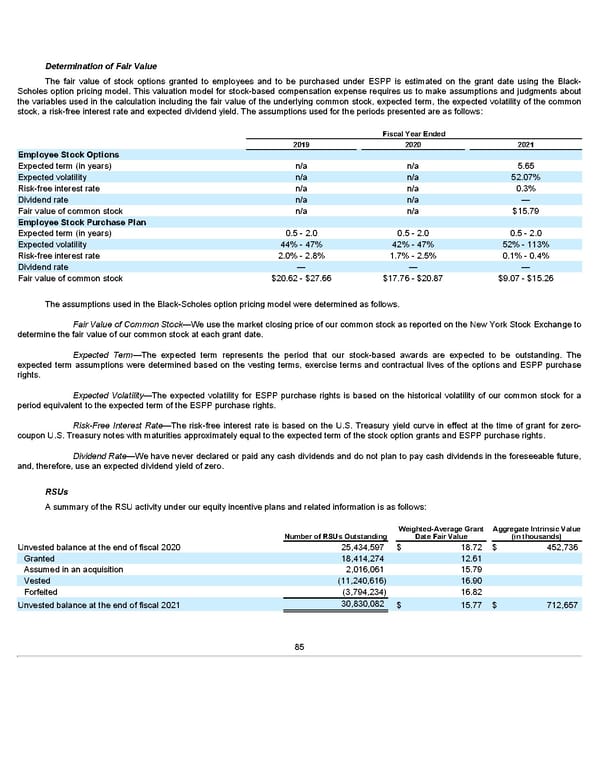

Determination of Fair Value The fair value of stock options granted to employees and to be purchased under ESPP is estimated on the grant date using the Black- Scholes option pricing model. This valuation model for stock-based compensation expense requires us to make assumptions and judgments about the variables used in the calculation including the fair value of the underlying common stock, expected term, the expected volatility of the common stock, a risk-free interest rate and expected dividend yield. The assumptions used for the periods presented are as follows: Fiscal Year Ended 2019 2020 2021 Employee Stock Options Expected term (in years) n/a n/a 5.65 Expected volatility n/a n/a 52.07% Risk-free interest rate n/a n/a 0.3% Dividend rate n/a n/a — Fair value of common stock n/a n/a $15.79 Employee Stock Purchase Plan Expected term (in years) 0.5 - 2.0 0.5 - 2.0 0.5 - 2.0 Expected volatility 44% - 47% 42% - 47% 52% - 113% Risk-free interest rate 2.0% - 2.8% 1.7% - 2.5% 0.1% - 0.4% Dividend rate — — — Fair value of common stock $20.62 - $27.66 $17.76 - $20.87 $9.07 - $15.26 The assumptions used in the Black-Scholes option pricing model were determined as follows. Fair Value of Common Stock—We use the market closing price of our common stock as reported on the New York Stock Exchange to determine the fair value of our common stock at each grant date. Expected Term—The expected term represents the period that our stock-based awards are expected to be outstanding. The expected term assumptions were determined based on the vesting terms, exercise terms and contractual lives of the options and ESPP purchase rights. Expected Volatility—The expected volatility for ESPP purchase rights is based on the historical volatility of our common stock for a period equivalent to the expected term of the ESPP purchase rights. Risk-Free Interest Rate—The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for zero- coupon U.S. Treasury notes with maturities approximately equal to the expected term of the stock option grants and ESPP purchase rights. Dividend Rate—We have never declared or paid any cash dividends and do not plan to pay cash dividends in the foreseeable future, and, therefore, use an expected dividend yield of zero. RSUs A summary of the RSU activity under our equity incentive plans and related information is as follows: Weighted-Average Grant Aggregate Intrinsic Value Number of RSUs Outstanding Date Fair Value (in thousands) Unvested balance at the end of fiscal 2020 25,434,597 $ 18.72 $ 452,736 Granted 18,414,274 12.61 Assumed in an acquisition 2,016,061 15.79 Vested (11,240,616) 16.90 Forfeited (3,794,234) 16.82 30,830,082 Unvested balance at the end of fiscal 2021 $ 15.77 $ 712,657 85

Annua lReport Page 84 Page 86

Annua lReport Page 84 Page 86