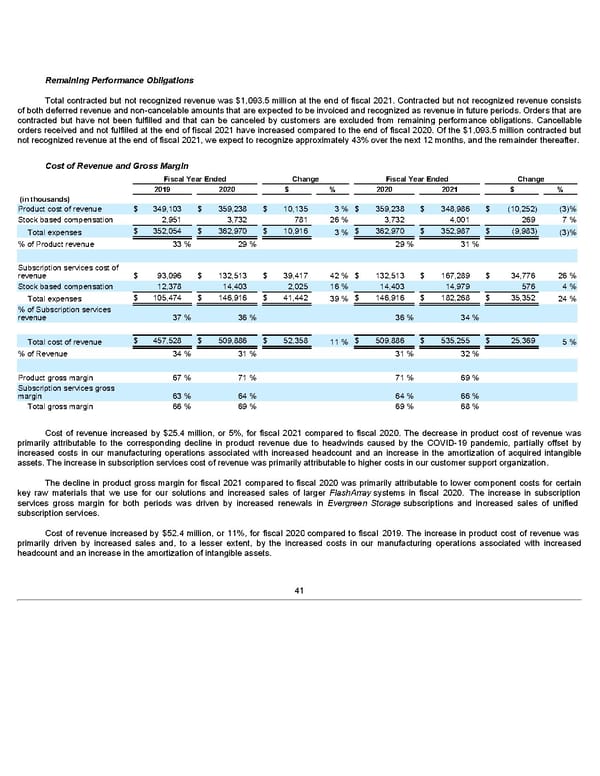

Remaining Performance Obligations Total contracted but not recognized revenue was $1,093.5 million at the end of fiscal 2021. Contracted but not recognized revenue consists of both deferred revenue and non-cancelable amounts that are expected to be invoiced and recognized as revenue in future periods. Orders that are contracted but have not been fulfilled and that can be canceled by customers are excluded from remaining performance obligations. Cancellable orders received and not fulfilled at the end of fiscal 2021 have increased compared to the end of fiscal 2020. Of the $1,093.5 million contracted but not recognized revenue at the end of fiscal 2021, we expect to recognize approximately 43% over the next 12 months, and the remainder thereafter. Cost of Revenue and Gross Margin Fiscal Year Ended Change Fiscal Year Ended Change 2019 2020 $ % 2020 2021 $ % (in thousands) Product cost of revenue $ 349,103 $ 359,238 $ 10,135 3 % $ 359,238 $ 348,986 $ (10,252) (3)% Stock based compensation 2,951 3,732 781 26 % 3,732 4,001 269 7 % $ 352,054 $ 362,970 $ 10,916 $ 362,970 $ 352,987 $ (9,983) Total expenses 3 % (3)% % of Product revenue 33 % 29 % 29 % 31 % Subscription services cost of revenue $ 93,096 $ 132,513 $ 39,417 42 % $ 132,513 $ 167,289 $ 34,776 26 % Stock based compensation 12,378 14,403 2,025 16 % 14,403 14,979 576 4 % $ 105,474 $ 146,916 $ 41,442 $ 146,916 $ 182,268 $ 35,352 Total expenses 39 % 24 % % of Subscription services revenue 37 % 36 % 36 % 34 % $ 457,528 $ 509,886 $ 52,358 $ 509,886 $ 535,255 $ 25,369 Total cost of revenue 11 % 5 % % of Revenue 34 % 31 % 31 % 32 % Product gross margin 67 % 71 % 71 % 69 % Subscription services gross margin 63 % 64 % 64 % 66 % Total gross margin 66 % 69 % 69 % 68 % Cost of revenue increased by $25.4 million, or 5%, for fiscal 2021 compared to fiscal 2020. The decrease in product cost of revenue was primarily attributable to the corresponding decline in product revenue due to headwinds caused by the COVID-19 pandemic, partially offset by increased costs in our manufacturing operations associated with increased headcount and an increase in the amortization of acquired intangible assets. The increase in subscription services cost of revenue was primarily attributable to higher costs in our customer support organization. The decline in product gross margin for fiscal 2021 compared to fiscal 2020 was primarily attributable to lower component costs for certain key raw materials that we use for our solutions and increased sales of larger FlashArray systems in fiscal 2020. The increase in subscription services gross margin for both periods was driven by increased renewals in Evergreen Storage subscriptions and increased sales of unified subscription services. Cost of revenue increased by $52.4 million, or 11%, for fiscal 2020 compared to fiscal 2019. The increase in product cost of revenue was primarily driven by increased sales and, to a lesser extent, by the increased costs in our manufacturing operations associated with increased headcount and an increase in the amortization of intangible assets. 41

Annua lReport Page 40 Page 42

Annua lReport Page 40 Page 42