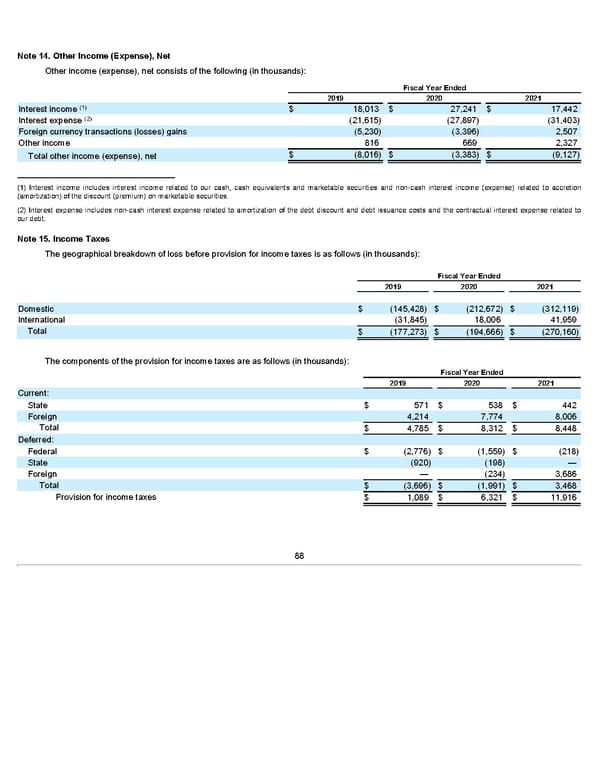

Note 14. Other Income (Expense), Net Other income (expense), net consists of the following (in thousands): Fiscal Year Ended 2019 2020 2021 (1) Interest income $ 18,013 $ 27,241 $ 17,442 (2) Interest expense (21,615) (27,897) (31,403) Foreign currency transactions (losses) gains (5,230) (3,396) 2,507 Other income 816 669 2,327 $ (8,016) $ (3,383) $ (9,127) Total other income (expense), net _________________________________ (1) Interest income includes interest income related to our cash, cash equivalents and marketable securities and non-cash interest income (expense) related to accretion (amortization) of the discount (premium) on marketable securities. (2) Interest expense includes non-cash interest expense related to amortization of the debt discount and debt issuance costs and the contractual interest expense related to our debt. Note 15. Income Taxes The geographical breakdown of loss before provision for income taxes is as follows (in thousands): Fiscal Year Ended 2019 2020 2021 Domestic $ (145,428) $ (212,672) $ (312,119) International (31,845) 18,006 41,959 Total $ (177,273) $ (194,666) $ (270,160) The components of the provision for income taxes are as follows (in thousands): Fiscal Year Ended 2019 2020 2021 Current: State $ 571 $ 538 $ 442 Foreign 4,214 7,774 8,006 Total $ 4,785 $ 8,312 $ 8,448 Deferred: Federal $ (2,776) $ (1,559) $ (218) State (920) (198) — Foreign — (234) 3,686 Total $ (3,696) $ (1,991) $ 3,468 Provision for income taxes $ 1,089 $ 6,321 $ 11,916 88

Annua lReport Page 87 Page 89

Annua lReport Page 87 Page 89