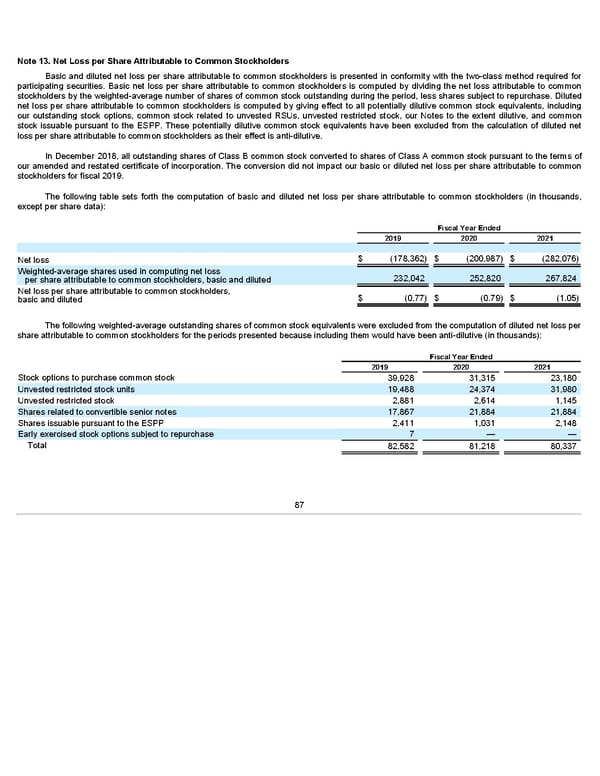

Note 13. Net Loss per Share Attributable to Common Stockholders Basic and diluted net loss per share attributable to common stockholders is presented in conformity with the two-class method required for participating securities. Basic net loss per share attributable to common stockholders is computed by dividing the net loss attributable to common stockholders by the weighted-average number of shares of common stock outstanding during the period, less shares subject to repurchase. Diluted net loss per share attributable to common stockholders is computed by giving effect to all potentially dilutive common stock equivalents, including our outstanding stock options, common stock related to unvested RSUs, unvested restricted stock, our Notes to the extent dilutive, and common stock issuable pursuant to the ESPP. These potentially dilutive common stock equivalents have been excluded from the calculation of diluted net loss per share attributable to common stockholders as their effect is anti-dilutive. In December 2018, all outstanding shares of Class B common stock converted to shares of Class A common stock pursuant to the terms of our amended and restated certificate of incorporation. The conversion did not impact our basic or diluted net loss per share attributable to common stockholders for fiscal 2019. The following table sets forth the computation of basic and diluted net loss per share attributable to common stockholders (in thousands, except per share data): Fiscal Year Ended 2019 2020 2021 $ (178,362) $ (200,987) $ (282,076) Net loss Weighted-average shares used in computing net loss 232,042 252,820 267,824 per share attributable to common stockholders, basic and diluted Net loss per share attributable to common stockholders, $ (0.77) $ (0.79) $ (1.05) basic and diluted The following weighted-average outstanding shares of common stock equivalents were excluded from the computation of diluted net loss per share attributable to common stockholders for the periods presented because including them would have been anti-dilutive (in thousands): Fiscal Year Ended 2019 2020 2021 Stock options to purchase common stock 39,928 31,315 23,180 Unvested restricted stock units 19,488 24,374 31,980 Unvested restricted stock 2,881 2,614 1,145 Shares related to convertible senior notes 17,867 21,884 21,884 Shares issuable pursuant to the ESPP 2,411 1,031 2,148 Early exercised stock options subject to repurchase 7 — — Total 82,582 81,218 80,337 87

Annua lReport Page 86 Page 88

Annua lReport Page 86 Page 88